Hyperbridge: The End of Fragile Bridges

Cross-chain is cracking under its own weight.

Cross-chain is the plumbing of crypto. It moves value, liquidity, and messages between networks. But instead of being reliable infrastructure, it has become the system’s biggest weakness. Bridges are fragile. They have been at the center of the largest hacks in crypto history, with $2.8 billion lost in the last two years alone, leaving confidence badly shaken.

The way most bridges work today is fragile by design. Users deposit funds into an intermediary. A representation is minted somewhere else. Capital piles up in honeypots. Attackers search for cracks, and when they find them, the entire system comes crashing down. Users lose money. Builders lose confidence. And the same cycle repeats.

Behind the branding, most “decentralized” bridges are not decentralized at all.

They rely on committees, multisigs, or validator sets that users are forced to trust. These middlemen become custodians of assets, often with little transparency. That is not sovereignty. It is custody by another name.

If crypto is to move beyond speculation into real finance and global adoption, this cannot be the status quo. Interoperability cannot remain the weakest link. It has to be secure, permissionless, and decentralized.

A different path forward with Hyperbridge

Hyperbridge was built to solve the failures that define cross-chain today. Instead of relying on middlemen, it uses proofs. When assets move between chains, they stay under the security of their original validator set. No guardians. No multisigs.

This is what makes Hyperbridge different. It introduces no new trust assumptions beyond the chains you already rely on. The system doesn’t ask you to hand over your assets or hope a committee behaves. You keep custody from start to finish.

For years, people described this kind of interoperability as a distant goal, something that might only be possible with advanced zero-knowledge proofs or technology that hadn’t arrived yet. Hyperbridge makes that future real today. By combining Polkadot’s security with a proof-based architecture, it delivers an interoperability layer that is open, safe, and incorruptible.

For readers who want the full technical breakdown, see the Introducing Hyperbridge Interoperability Coprocessor. Hyperbridge is not just another bridge. It is the first protocol that brings true decentralization to interoperability. Built from the ground up by founders who know what it means to be excluded from global systems, it was designed with one purpose: to make cross-chain connectivity fair, verifiable, and unstoppable.

Introducing $BRIDGE

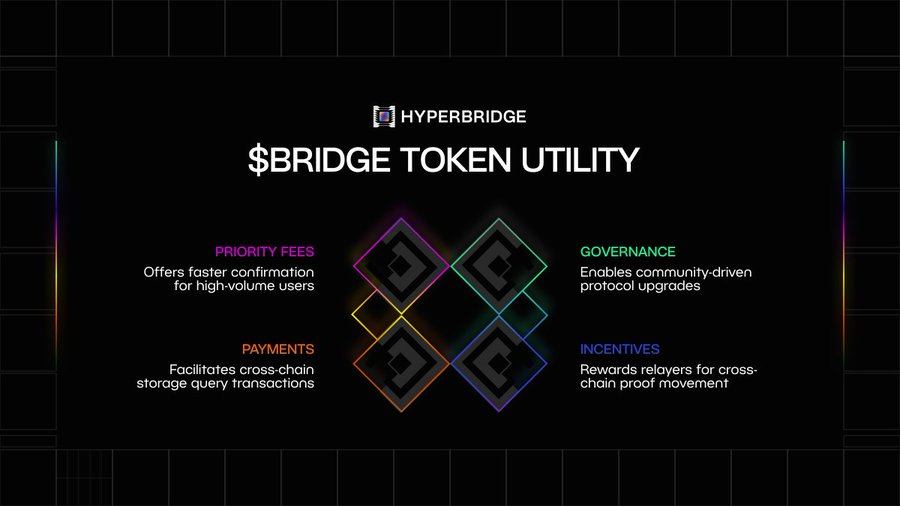

At the core of Hyperbridge is its native token: $BRIDGE. It is the fuel that keeps the system running, aligning incentives across everyone who uses, builds, and secures the protocol.

The utility of $BRIDGE spans multiple layers:

- Governance over protocol upgrades and decision-making

- Incentives for relayers who move proofs between chains

- Payments for cross-chain storage queries

- Priority fees for high-volume users who want faster confirmation

But $BRIDGE is more than just utility. It is the narrative anchor for Hyperbridge. Owning BRIDGE is a statement: you are betting on the collapse of the old bridge model.

The reason is simple. Every other bridge relies on custodians, validator sets, or multisigs.

They introduce new trust assumptions and create honeypots that attackers target again and again. History shows what happens next: hacks, failures, and billions in losses. These designs cannot last.

Hyperbridge is different. It is proof-based, fully decentralized, and incorruptible. That is why in five years, when the bridges you know today are gone, Hyperbridge will remain. The safest bridge. The only bridge. Imagine being able to short every insecure bridge at once. Hyperbridge is that trade.

Why this moment matters for crypto

For years, bridges have been the most dangerous chokepoint in crypto. They’ve been responsible for billions in losses because they relied on custody, committees, and validator sets rather than proofs. The launch of $BRIDGE changes that equation.

$BRIDGE unlocks Hyperbridge’s Intents Gateway, it’s a breakthrough product that lets users swap seamlessly across chains by simply stating what they want, and having it executed securely and transparently. No middlemen. No hidden custody. Just proof-based interoperability that works as crypto was meant to.

This matters because it proves that a bridge doesn’t have to be a vulnerability. It can be the foundation for permissionless cross-chain applications. With $BRIDGE, incentives are aligned for relayers, liquidity providers, and users. The result is an interoperability layer that is incorruptible, secure, and built to last.

At launch, the Intents Gateway will support USDC, USDT, & ETH, while more assets will be added rapidly in the weeks ahead, expanding access and proving Hyperbridge as the safest, most scalable entry point into the multichain economy.

Hyperbridge isn’t just releasing a token. It’s setting a new standard for how interoperability is built, and showing the industry that the bridge problem can finally be solved.

Inside the $BRIDGE economy

Earlier this year, Hyperbridge introduced the Initial Relayer Offering, an early sale created to bring the right actors into the network from day one. The goal wasn’t just to raise capital, but to align with relayers and ecosystem participants who would help secure and operate the protocol.

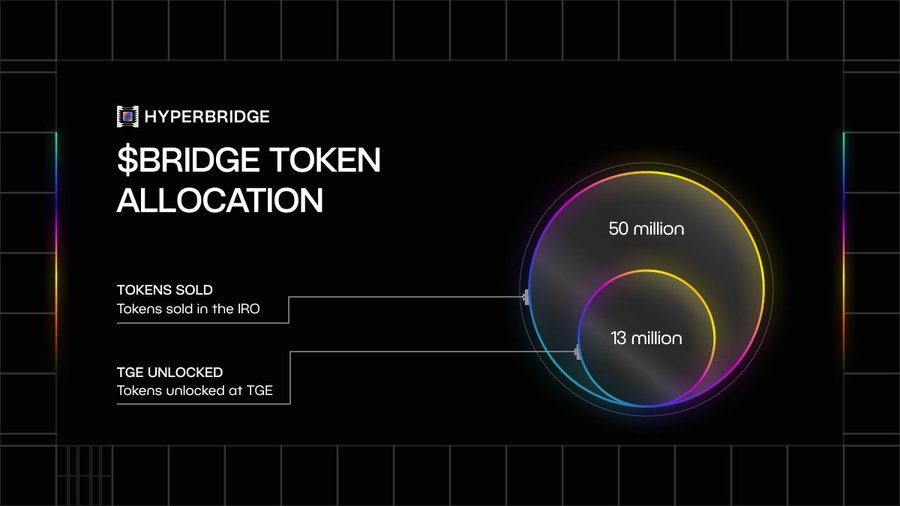

The IRO sold over 50 million $BRIDGE tokens, raising $2.8 million and bringing Hyperbridge’s total funding to $5.65 million. Participants received allocations under clear terms: 25% unlocked at TGE, with the rest vesting linearly over 18 months. In doing so, the IRO established a foundation of long-term operators and early backers whose incentives were directly tied to the protocol’s success.

Now comes the TGE, the moment $BRIDGE is minted and made available to the wider market. Where the IRO was about building alignment with core operators, the TGE is about opening the door to everyone else.

Key tokenomics at TGE:

- Total Supply: 1 billion $BRIDGE tokens (fixed)

- Initial Valuation: $50 million FDV

- Circulating Supply at TGE: 12.5 million tokens ($625,000)

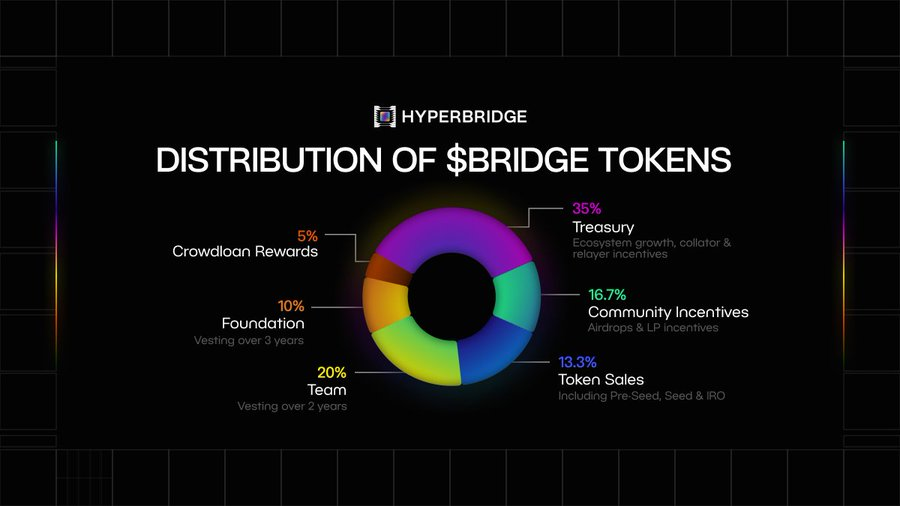

- Distribution:

- Treasury: 35% (Ecosystem growth, collator & relayer incentives)

- Community Incentives: 16.7% (Airdrops & LP incentives)

- Token Sales: 13.3% (Including Pre-Seed, Seed & IRO)

- Team: 20% (Vesting over 2 years)

- Foundation: 10% (Vesting over 3 years)

- Crowdloan Rewards: 5%

- IRO participants: 25% unlocked at TGE, 75% vested over 18 months

- Team and foundation: locked at TGE, vested over 24 months

- Treasury: locked and governed for ecosystem growth

- Circulating supply at TGE: primarily IRO allocations

This structure ensures transparency and long-term alignment. Only a small fraction of tokens are liquid at launch, while the majority are locked to secure the protocol’s future.

And $BRIDGE is not just another token. It is what makes Hyperbridge work. It powers governance, incentivizes relayers, pays for cross-chain queries, and secures transaction ordering. It also connects directly to the community through the upcoming points program, where rewards and incentives will be distributed in $BRIDGE, making every user a stakeholder in the protocol’s growth.

Treasury mechanics: Fees collected from bridge and swap usage flow back into the treasury. This pool funds protocol growth, ecosystem incentives, and community rewards, ensuring that value created by Hyperbridge stays within the network.

This design ensures that $BRIDGE is not just a utility token, but a sustainable asset that powers adoption, security, and long-term growth.

Be part of what comes next

Hyperbridge is building more than a bridge. It is building the foundation for a multichain world that is open, safe, and incorruptible. As the safest bridge in crypto, Hyperbridge is how you move across chains without compromise, and $BRIDGE is how you become part of that story.

The future of interoperability will not be controlled by committees, custodians, or closed systems. It will be owned by the community that believes in sovereignty, fairness, and decentralization.

The next chapter starts now.

Join the community on Telegram, Discord, and X to stay updated. Big announcements are coming soon.